THE RESERVE Bank of India Friday left the repo rate — the rate at which it lends to banks — unchanged at 6.5 per cent on concerns over rise in food inflation, and revised upwards the real gross domestic product (GDP) growth projection for 2024-25 to 7.2 per cent.

The central bank retained the FY25 consumer price index based inflation (CPI) projection at 4.5 per cent but indicated that it will fall below 4 per cent during the July-September quarter.

The members of the RBI’s Monetary Policy Committee which met over the last three days decided to leave the key policy rate at 6.5 per cent for the eight consecutive time. However, a growing divergence in views within the MPC was visible this time, with two external members — Ashima Goyal and Jayanth R Varma — voting to reduce the policy repo rate by 25 basis points. In the previous two monetary policies, Varma was the only MPC member to vote for a 25 basis points cut in the repo rate.

The monetary policy stance was also retained at ‘withdrawal of accommodation’ in a 4:2 majority. Goyal and Varma voted for a change in stance to ‘neutral’.

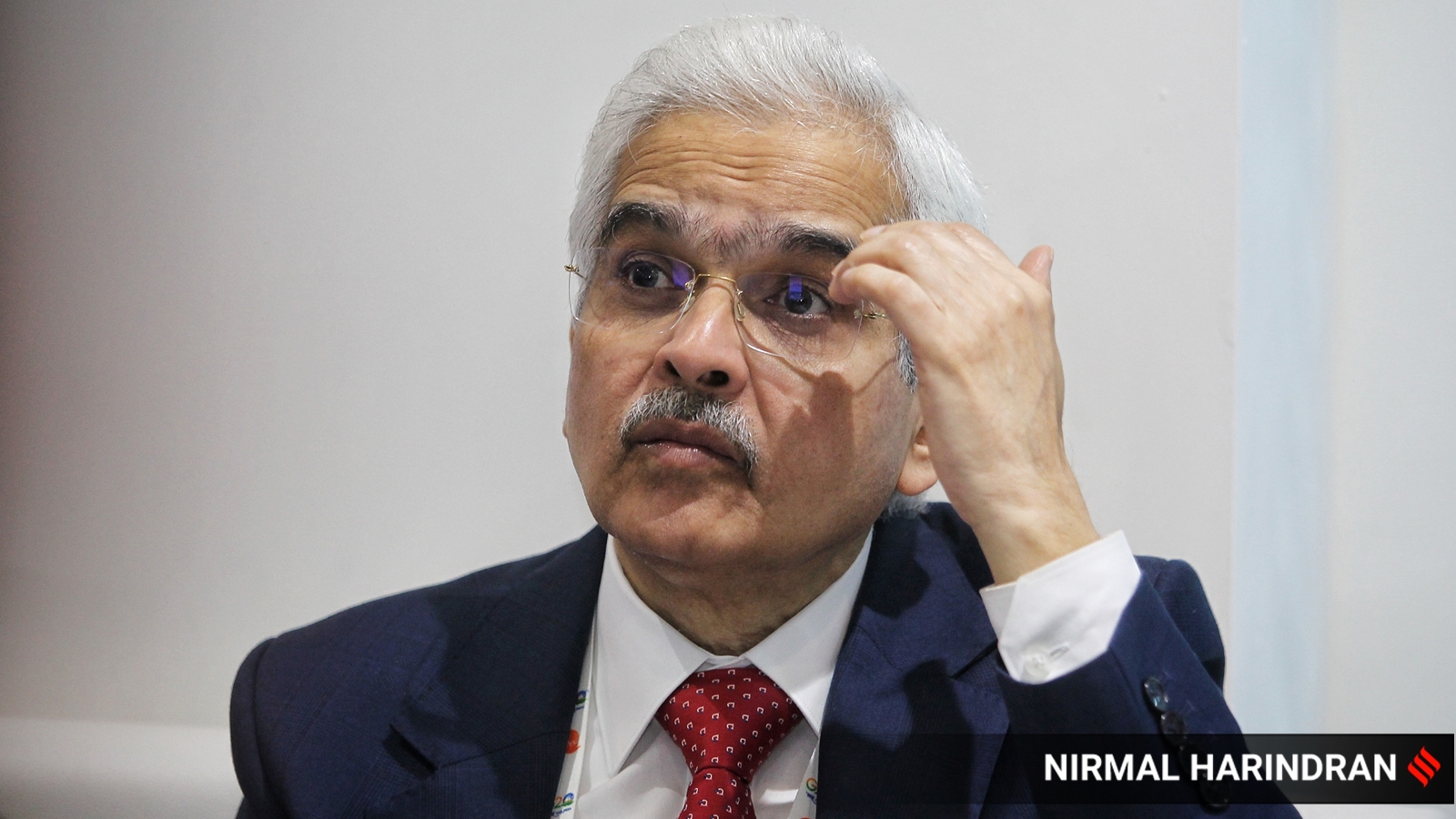

“While the MPC took note of the disinflation achieved so far without hurting growth, it remains vigilant to any upside risks to inflation, particularly from food inflation, which could possibly derail the path of disinflation. Hence, monetary policy must continue to remain disinflationary and be resolute in its commitment to aligning inflation to the target of 4 per cent on a durable basis,” Reserve Bank of India’s Governor Shaktikanta Das said during the monetary policy announcement.

The RBI has been targeting to bring inflation down to 4 per cent on a durable basis. In April, headline inflation moderated to 4.8 per cent from 4.9 per cent in April.

Das said CPI headline inflation softened further during March-April, though persisting food inflation pressures offset the gains of disinflation in core and deflation in the fuel groups.

Despite some moderation, pulses and vegetables inflation remained firmly in double digits. Vegetable prices are experiencing a summer uptick following a shallow winter season correction.

The exceptionally hot summer season and low reservoir levels may put stress on the summer crop of vegetables and fruits, he said, adding that the rabi arrivals of pulses and vegetables need to be carefully monitored.

The global food prices have started inching up and prices of industrial metals have registered double digit growth in the current calendar year so far.

These trends, if sustained, could accentuate the recent uptick in input cost conditions for firms, Das said.

“Headline CPI inflation is moderating but the last mile of disinflation is sticky. Our target is 4 per cent on a durable basis and we will work towards that. The elephant (inflation) is walking very slowly. We are watchful and would like the elephant to enter the forest (at 4 per cent), and be there…we would like the inflation to align itself to the target (of 4 per cent) and be there on a durable basis,” Das said when asked about his assessment on the disinflationary process.

The RBI has projected CPI for Q1 at 4.9 per cent, Q2 at 3.8 per cent, Q3 at 4.6 per cent and Q4 at 4.5 per cent.

The second quarter of 2024-25 is likely to see some correction in headline inflation, but this is likely to be one-off on account of favourable base effects and may reverse in the third quarter, Das said.

The RBI raised the FY25 real GDP forecast by 20 basis points (bps) to 7.2 per cent from an earlier estimate of 7 per cent. One basis point (bps) is one-hundredth of a percentage point.

The GDP growth projection for Q1 FY25 was revised upwards to 7.3 per cent (vs 7.1 per cent in the April policy), for Q2 to 7.2 per cent (vs 6.9 per cent), for Q3 to 7.3 per cent (vs 7 per cent) and for Q4 to 7.2 per cent (vs 7 per cent).

“GDP growth outlook is bright. The momentum of economic activity is well sustained. GDP growth projection of 7.2 per cent for 2024-25, when it materialises, will be the fourth consecutive year of growth at or above 7 per cent. In fact, the average growth in the last three years ending 2023-24 exceeds 8 per cent,” Das said.

Rate cut or not

THERE IS growing divergence within the RBI monetary policy committee on the need for lowering interest rates. Two of the six MPC members sought a 25 basis point cut, and also a change in policy stance from ‘withdrawal of accommodation’ to ‘neutral’.

However, headwinds from geopolitical tensions, volatility in international commodity prices, and geo-economic fragmentation can pose risks to the growth outlook, the RBI said.

Commenting on the RBI policy, State Bank of India Chairman Dinesh Khara said, “The RBI growth upgrade in policy reaffirmed India’s continued robust growth post pandemic. Domestic growth inflation outlook has moved favourably with inflation moving below 4 per cent in Q2.

HDFC Bank Chief Economist and Executive Vice President Abheek Barua said the RBI remains in a wait and watch mode to assess domestic developments like the monsoon performance, food inflation, and the new fiscal strategy before moving on rates.

“We continue to see the possibility of a rate cut in Q4 2024,” he said.

Despite the governors’ emphasis that monetary policy decisions are driven primarily by domestic considerations, Barua said that any rate cut action could end up being aligned with the timing of the US Fed’s rate cut cycle to limit financial market volatility.

Omprakash Tiwary is a business writer who delves into the intricacies of the corporate world. With a focus on finance and economic landscape. He offers readers valuable insights into market trends, entrepreneurship, and economic developments.