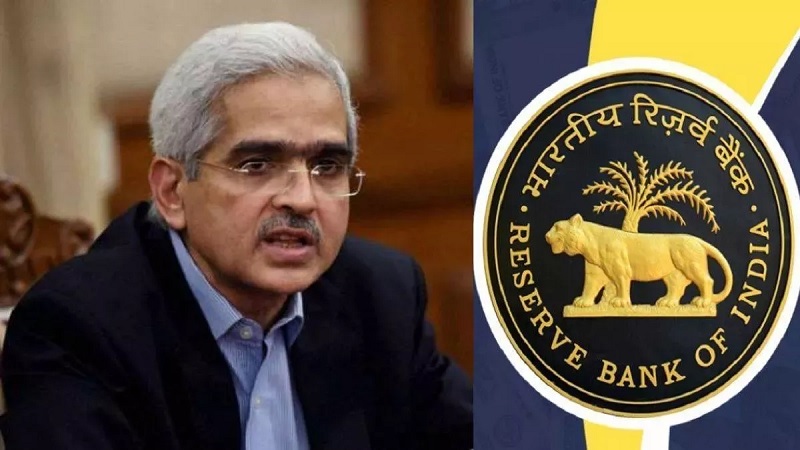

The Reserve Bank of India keeps strict surveillance on the banks. RBI also takes strict action against any bank which disobeys the rules.

New Delhi. Violating the rules of Reserve Bank of India (RBI) has cost heavily to 5 co-operative banks. While RBI has imposed fine on 4 banks, the license of one co-operative bank has been cancelled. The name of the bank whose license has been canceled is Urban Co-operative Bank Limited. This bank works in Sitapur, Uttar Pradesh. RBI says that this co-operative bank has no capital left for operations. Not only this, there is no hope of further earnings in the bank. That’s why this bank is being closed.

Only after the action of RBI, Urban Cooperative Bank had to stop its work from 7th December. RBI also directed the Commissioner and Registrar, Uttar Pradesh to take appropriate action to close the bank. RBI says that the bank also did not make full payment to the customers. The good thing is that most of the customers of the bank will get back almost their entire capital deposited in the bank. The bank said that 98.32 percent customers will be refunded their entire money. Deposits up to Rs 5 lakh are insured. 98.32 percent of the bank’s customers have deposits of Rs 5 lakh or less.

Fine imposed on these banks

Reserve Bank of India imposed fine on 4 co-operative banks. The banks on which fine has been imposed include Patan Co-operative Bank, Rajarshi Shahu Co-operative Bank, District Central Bank and Primary Teachers Co-operative Bank. Out of these four banks, a fine of Rs 1 lakh each was imposed on 3 banks and a fine of Rs 10,000 was imposed on another bank.

That’s why the fine was imposed

The District Central Bank was not following the guidelines of NABARD. At the same time, KYC rules were ignored by Patan Co-operative Bank. Shikshak Co-operative Bank provided gold loan against the rules of RBI whereas Rajarshi Shahu Co-operative Bank is not following the rules of minimum balance.

We have taken all measures to ensure that the information provided in this article and on our social media platform is credible, verified and sourced from other Big media Houses. For any feedback or complaint, reach out to us at [email protected]

Omprakash Tiwary is a business writer who delves into the intricacies of the corporate world. With a focus on finance and economic landscape. He offers readers valuable insights into market trends, entrepreneurship, and economic developments.