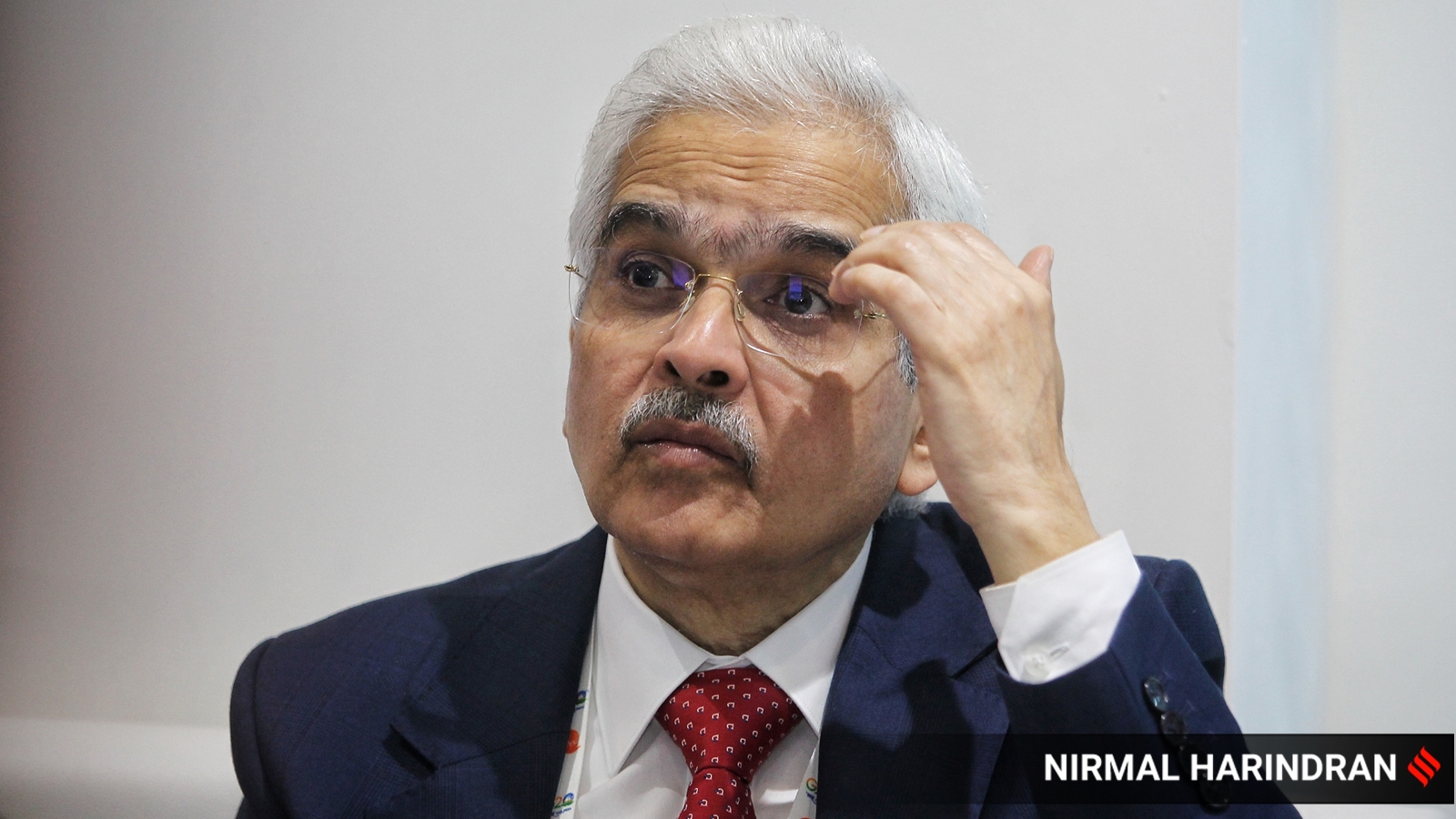

Week Ahead: RBI Policy, Q1 Results, Israel-Iran conflict, global cues among key market triggers this week

The Indian equity market exhibited volatility over the past week, ultimately closing marginally lower amid mixed signals. After a subdued start, the Nifty 50 index remained range-bound for most of the week, showing signs of fatigue. Selective buying in key heavyweights across sectors kept the sentiment positive. In the first week of August, investors will …