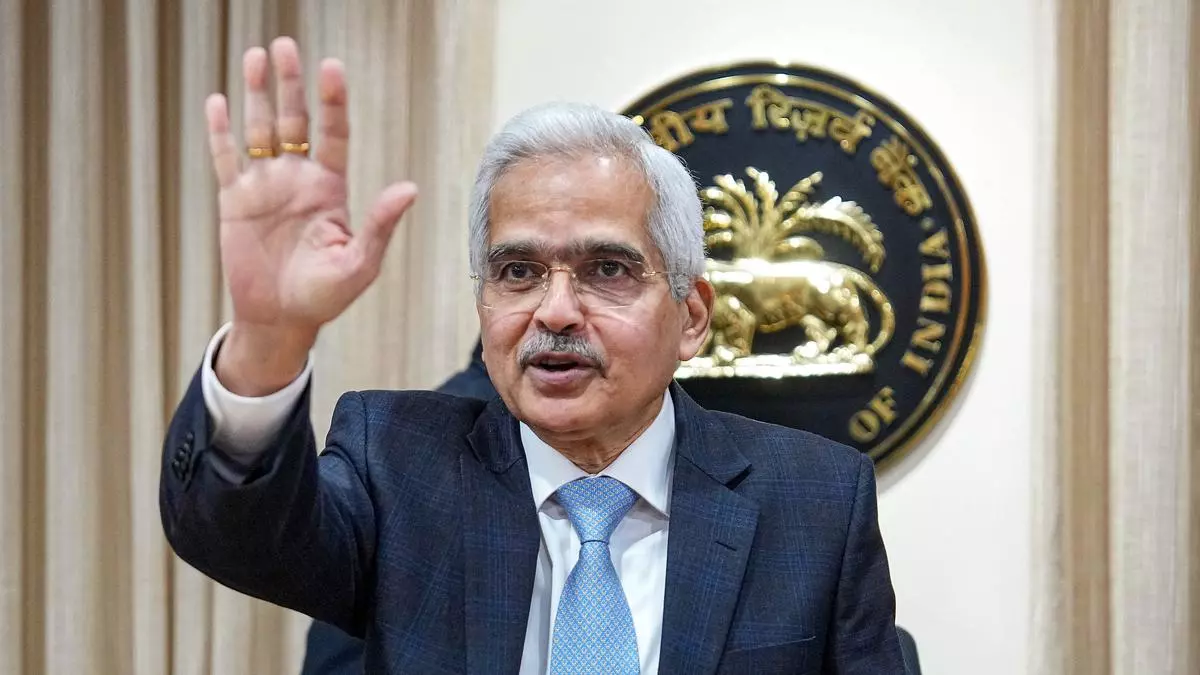

RBI Monetary Policy June 2024 Highlights: RBI holds repo rate at 6.50%; forecasts 7.2% GDP growth for FY25

Aspirational Goals for RBI@100 in a Multi-Year Time Frame: 1. Monetary Policy and Liquidity Management Positioning the Reserve Bank as Leader of the Global South Review of Monetary Policy Framework to address: Balancing price stability and economic growth from an Emerging Market Economy (EME) perspective; Refinements in monetary policy communication; and …